The cryptocurrency market is no stranger to milestones, but Bitcoin reaching $100,000 would mark a transformative moment not just for digital assets but for the entire trading ecosystem. For Canadian traders, the implications of this six-figure valuation go far beyond price speculation—it impacts trading platforms, market dynamics, and strategies. From institutional investors to retail traders, everyone stands to experience a seismic shift in how digital and traditional assets are approached. Here’s what this means for trading in Canada, with insights from CA-XE, a trusted broker providing cutting-edge tools and strategies.

Bitcoin at $100K: A New Era for Crypto Trading in Canada

When Bitcoin crosses the $100K threshold, the repercussions for Canadian trading platforms and traders will be significant. As a widely traded digital asset, Bitcoin has long been the anchor of the crypto market. At this valuation, however, its influence on trading behaviors and market strategies could rival even traditional commodities like gold.

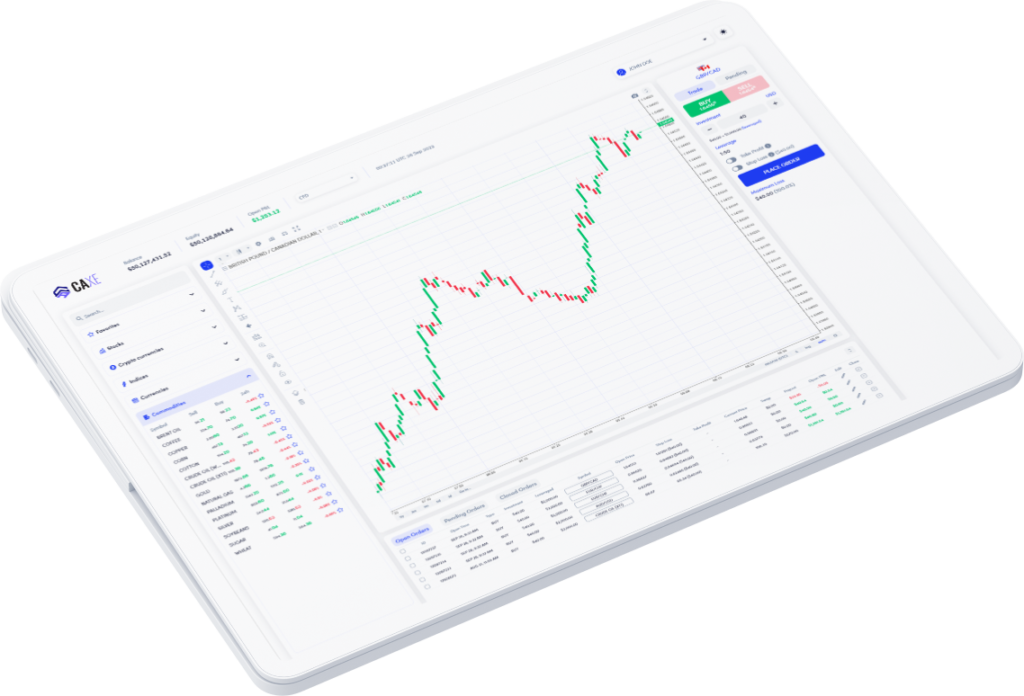

Trading platforms in Canada will need to evolve rapidly to support this new era of high-stakes trading. According to CA-XE, ensuring robust infrastructure, liquidity, and access to innovative trading tools will be essential. High volumes of trades, spurred by Bitcoin’s skyrocketing value, will demand seamless execution and enhanced security measures.

How Trading Platforms are Preparing for $100K Bitcoin

Canadian trading platforms are no strangers to Bitcoin’s volatility. However, a $100K valuation places entirely new demands on their capabilities. Platforms like CA-XE are already adapting to meet these challenges by providing a blend of advanced technology and user-centric features:

- Scalability and Reliability

The high trading volume anticipated at this valuation requires scalable infrastructure. Platforms are focusing on minimizing downtime and ensuring fast transaction speeds, even during peak activity. - Advanced Analytics

Traders at all levels will benefit from sophisticated tools that offer real-time insights and predictive analytics. CA-XE has invested in providing market overviews that allow users to assess opportunities across crypto and commodities with precision. - Diverse Trading Instruments

Bitcoin at $100K opens doors for advanced trading instruments like futures, options, and leveraged products. For Canadian traders, this means opportunities to hedge positions or amplify returns, provided they have access to the right tools and guidance. - Enhanced Security Measures

The stakes are higher than ever, and so are the risks. Platforms are doubling down on encryption protocols, two-factor authentication, and anti-fraud measures to protect user assets.

Opportunities for Canadian Traders

The $100K milestone doesn’t just benefit platforms—it’s a game-changer for traders as well. Here are some key opportunities:

- Institutional Confidence: Bitcoin’s six-figure price point is likely to attract institutional investors who were previously on the sidelines. Their involvement could stabilize markets and increase liquidity.

- Diversification: Traders can leverage Bitcoin’s performance to explore altcoins or traditional commodities, creating a balanced and diversified portfolio.

- Market Sentiment: A $100K Bitcoin could boost overall market sentiment, encouraging new traders to enter the crypto space. Platforms like CA-XE are positioned to provide accessible resources to educate and empower these newcomers.

The Ripple Effect on Commodities and Traditional Markets

Bitcoin’s rise to $100K doesn’t happen in isolation. Its increasing valuation could position it as a competitor to traditional commodities like gold, which has long been considered a safe haven asset. This shift could influence the trading strategies of Canadian investors, as they weigh the merits of digital versus physical assets.

Moreover, the crossover between crypto and traditional markets is expected to grow. Platforms offering both crypto and commodities trading will become essential hubs for investors seeking to navigate this new landscape. CA-XE stands out in this regard, offering seamless integration between diverse asset classes, ensuring traders can capitalize on opportunities across the board.

Challenges and Risks

As promising as Bitcoin’s ascent to $100K appears, it is not without challenges. High volatility can lead to significant price swings, creating potential risks for traders. For newer participants, the allure of large profits must be tempered with caution and risk management.

In addition, regulatory developments in Canada could influence how Bitcoin and other cryptocurrencies are traded. Platforms like CA-XE are committed to helping traders stay informed about compliance requirements while offering transparent and secure trading environments.

The Future of Trading Platforms

A six-figure Bitcoin isn’t just a milestone—it’s a call to action for trading platforms to innovate. From integrating AI-driven insights to introducing fractional trading, platforms must adapt to meet the evolving needs of traders. CA-XE, with its user-focused approach and advanced technology, is well-positioned to lead this charge.

The journey to $100K is more than just a numeric achievement—it represents a shift in how Canadians view and interact with digital assets. With the right tools and strategies, traders can seize this moment to build wealth and diversify their portfolios.

Whether you’re a seasoned trader or just starting your journey, CA-XE offers the tools, insights, and resources you need to navigate the exciting world of Bitcoin at $100K and beyond. From real-time market analytics to a secure and user-friendly trading platform, CA-XE empowers traders to succeed in any market condition.

Join the trading revolution today by visiting CA-XE’s website to explore opportunities and start trading with confidence.

Disclaimer: Cryptocurrency trading involves significant risks, including the loss of principal. Past performance is not indicative of future results. Bitcoin and other cryptocurrencies are volatile assets and may not be suitable for all investors. Please conduct thorough research and consult with a financial advisor before trading.